If you have ever wondered, ‘Is VAT and GST the same?’ you are not alone. Many business owners are caught off guard by the subtle yet important differences. In this blog, we will explore and explain the key distinctions between these two taxes.

Why Where You Do Business Changes Everything

The way your goods and services are taxed depends heavily on where you do business. Both VAT (Value Added Tax) and GST (Goods and Services Tax) are taxes applied to consumer purchases. This means they are charged when a consumer buys a product or service.

However, different countries structure them differently. VAT is mostly used in Europe, the United Kingdom, and parts of Africa and Asia. GST is common in countries like Singapore, Australia, New Zealand, and Canada.

At first glance, they look identical. Both are multi-stage taxes collected at every point of the supply chain. Yet, when you dive deeper, key differences in application, administration, and compliance emerge.

How VAT Works and Why It Can Get Complicated

VAT, or Value Added Tax, is a system where each business in the supply chain pays tax on the value they add to a product or service. Businesses apply VAT to their sales (output tax) and recover VAT paid on their purchases (input tax).

For example:

- A supplier sells materials to a manufacturer and charges VAT.

- The manufacturer claims back the VAT paid on the materials and charges VAT when selling the finished product to a retailer.

- The retailer does the same when selling to the final consumer.

In theory, VAT ensures tax is paid evenly across all stages, but in practice, it can get complex. Multiple VAT rates may apply based on the product category or country rules. There are also exemptions and zero-rated goods to consider.

What Makes VAT Attractive and Where It Falls Short

Pros

- Input tax credits at every stage reduce the final tax burden.

- Widely adopted in Europe and beyond, making cross-border trade smoother.

- Helps prevent tax-on-tax (cascading tax) situations.

Cons

- Compliance can be highly complicated, especially with varying country rates.

- Requires detailed record-keeping and regular reporting.

- Hefty penalties for misfiling or non-compliance.

How GST Works for Singaporean Business Owners

GST, or Goods and Services Tax, operates similarly to VAT but is built to be more streamlined and business-friendly. In Singapore, GST is a broad-based consumption tax applied to the supply of goods and services as well as imports. The Inland Revenue Authority (IRAS) is responsible for administering it.

Here is what you must know

- The current GST rate in Singapore is 9% as of 2024.

- Businesses must register for GST if their taxable turnover exceeds SGD 1 million over a 12-month period.

- Once registered, businesses charge GST on their sales and can claim input GST on business purchases.

- Some supplies are exempt from GST, such as financial services and the sale and lease of residential properties.

- Zero-rated supplies, such as exported goods and international services, are taxed at 0%, allowing businesses to claim input GST.

- Businesses must file periodic GST returns, usually on a quarterly basis, and ensure timely and accurate compliance to avoid penalties.

Read more: What are the benefits of GST Registration in Singapore?

Singapore’s GST system is designed to be simpler compared to VAT systems in Europe, with a flat standard rate and clearer rules. In addition, Singapore offers schemes like the Major Exporter Scheme (MES) to ease cash flow for businesses heavily involved in international trade.

Navigating GST registration and compliance should not hold you back from growing your business. At Peter Leow Consulting (PLCO), we make the process simple and stress-free. Call us today at (65) 6932 5055 or email us at enquiry@plco.com.sg. We are ready to support your success.

Read more: Determining Supplies Applicable for Output Tax

Why GST Works Well for Singapore Businesses and What to Watch Out For

Pros

- Single flat rate simplifies tax calculation.

- Fewer exemptions make compliance easier.

- Encourages exports by zero-rating exported goods and services.

Cons

- Businesses must monitor their turnover closely to avoid late registration penalties.

- Certain supplies, such as financial services, are exempt, limiting input tax recovery.

- Late payment or incorrect GST filing attracts significant penalties.

Read more: Responsibilities of a GST-registered business

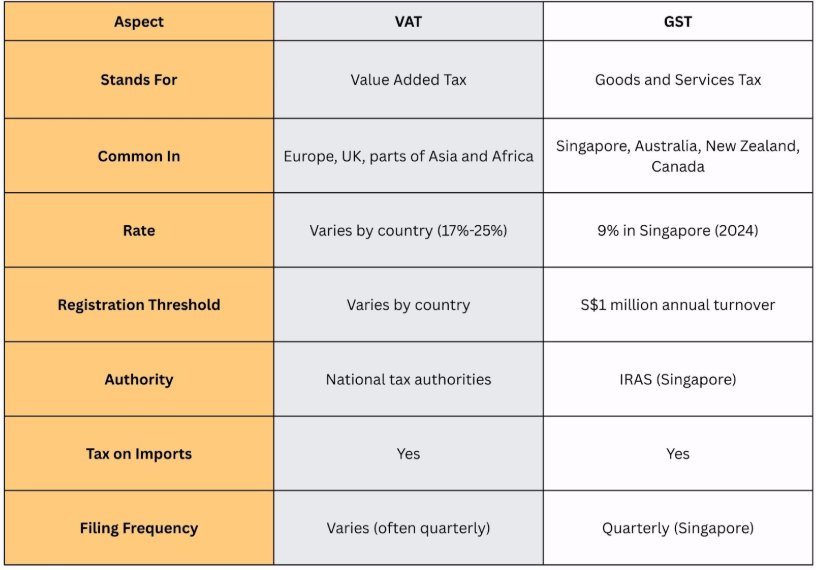

Simple Table to Help You Understand the Differences Fast

Here is a clear look at how VAT and Singapore’s GST system compare.

What Happens If Your Business Does Not Comply with GST Laws in Singapore

Failing to meet GST obligations in Singapore can lead to serious consequences. The Inland Revenue Authority of Singapore (IRAS) takes compliance seriously, and businesses that fall short may face:

- Penalties and Fines

Late registration, under-declaring GST, or late filing of GST returns can attract heavy penalties. Businesses may be fined up to S$10,000 and ordered to pay a 10% surcharge on the GST owed.

- Prosecution

In severe cases, deliberate fraud or repeated non-compliance could lead to court prosecution. Convictions can carry higher fines and even imprisonment.

- Audit Scrutiny

Non-compliant businesses are more likely to be audited by IRAS, leading to additional administrative burdens and reputational risks.

- Loss of Business Credibility

Non-compliance can damage a company’s reputation, affecting trust with suppliers, partners, and clients.

Apart from avoiding penalties, compliance also protects your business’s long-term growth and credibility.

Read more: 7 Common Mistakes To Avoid When Applying for GST Registration

Why Getting Professional Help Makes a Difference

Mistakes in VAT or GST compliance can lead to serious consequences. Keeping up with changing tax laws, filing deadlines, and claiming the right input tax requires expertise and attention to detail.

With the right support, you can stay compliant, avoid unnecessary stress, and build a business that thrives locally and internationally.

Worried about making a mistake? PLCO understands the challenges you face. Our team of experts is ready to guide you through GST compliance, from handling the paperwork to reporting, so you can spend more time doing what you love – growing your business. Call us at (65) 6932 5055 or email us at enquiry@plco.com.sg to book a consultation today.

Final Thought to Keep Your Business Moving Forward

VAT and GST might seem similar, but understanding the differences is crucial if you want your business to succeed. If you are expanding into new markets or simply want peace of mind in your home market, professional advice can make all the difference.

Speak to us today and take the first step towards smooth, stress-free tax compliance. Discover how we can help you here or send your enquiries to enquiry@plco.com.sg.